Just like the bustling markets of Raipur, your online store needs seamless transactions to thrive. Choosing the right payment gateway is crucial for your eCommerce success in Chhattisgarh and beyond. Let’s explore the best payment gateways that can empower your Indian online business.

In today’s digital age, a smooth and secure payment process is the backbone of any successful eCommerce venture. For businesses operating in India, and especially those targeting customers in Raipur, selecting the right payment gateway is paramount. It directly impacts customer trust, conversion rates, and ultimately, your bottom line. This comprehensive guide will delve into the best payment gateways available for Indian eCommerce sites, highlighting their features, benefits, and how they can help your business flourish.

Why Choosing the Right Payment Gateway Matters for Your Raipur eCommerce Store

Imagine a customer in Raipur eager to purchase your locally sourced handicrafts or unique apparel. If they encounter a clunky or unreliable payment process, they are likely to abandon their cart, leading to lost sales. A well-chosen payment gateway offers:

- Enhanced Security: Protecting sensitive customer data and ensuring secure transactions.

- Multiple Payment Options: Catering to the diverse preferences of Indian consumers, including UPI, credit/debit cards, net banking, and digital wallets.

- Seamless Integration: Easy integration with your existing eCommerce platform (like WordPress with WooCommerce).

- Reliability and Uptime: Ensuring that your payment processing is always available.

- Competitive Pricing: Understanding transaction fees and other charges.

- Local Currency Support: Processing payments in INR smoothly.

- Strong Customer Support: Access to timely assistance when issues arise.

Top Payment Gateways for Indian eCommerce in 2025

Here’s a detailed look at some of the leading payment gateways that can significantly benefit your eCommerce business in Raipur and across India:

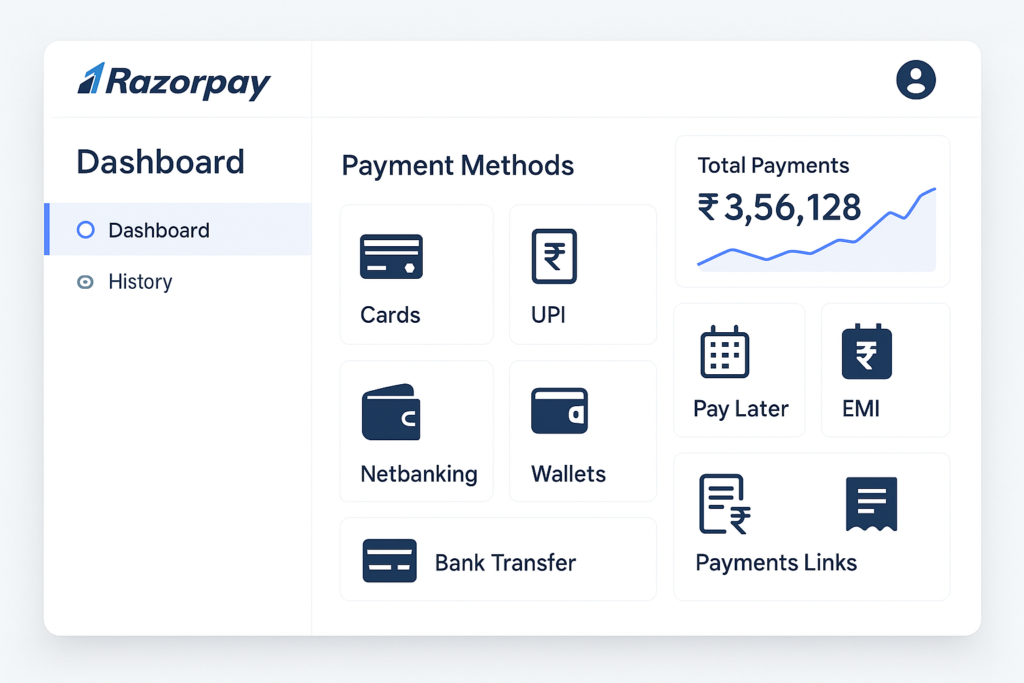

- Razorpay:

- Description: Razorpay (https://razorpay.com)has emerged as a popular choice for Indian businesses due to its comprehensive suite of features and developer-friendly APIs. It supports a wide array of payment methods, including UPI (BHIM, Google Pay, PhonePe, etc.), credit and debit cards (Visa, Mastercard, Rupay, American Express), net banking (across major Indian banks), and popular digital wallets.

- Key Features:

- Accepts all major payment methods.

- Offers a clean and intuitive dashboard.

- Provides robust APIs for seamless integration.

- Supports recurring payments, ideal for subscription-based businesses.

- Offers features like instant refunds and fraud detection.

- Competitive pricing with transparent fee structures.

- Excellent customer support.

- Why it’s great for Raipur businesses: Its widespread acceptance of UPI, which is highly popular in India, makes it a strong contender for reaching local customers.

2. Paytm Payment Gateway:

- Description: Leveraging the massive user base of the Paytm app (https://business.paytm.com/payment-gateway), the Paytm Payment Gateway provides a familiar and trusted payment experience for many Indian consumers. It supports Paytm Wallet, UPI, net banking, and credit/debit cards.

- Key Features:

- Seamless integration with the Paytm ecosystem.

- High transaction success rates due to user familiarity.

- Supports QR code payments, increasingly popular in India.

- Offers marketing tools and integrations.

- Provides detailed analytics and reporting.

- Why it’s great for Raipur businesses: The strong brand recognition and widespread use of Paytm in India, including Raipur, can boost customer confidence and conversions.

3. CCAvenue:

- Description: CCAvenue (https://www.ccavenue.com) is one of the oldest and most established payment gateways in India, supporting a vast number of payment options, including a wide range of international cards and multiple currencies.

- Key Features:

- Supports a large number of domestic and international payment methods.

- Offers multi-currency processing.

- Provides robust security features and fraud prevention.

- Supports multiple languages.

- Offers various integration options.

- Why it’s great for Raipur businesses: If your business in Raipur caters to a national or even international customer base, CCAvenue’s wide range of payment options and multi-currency support can be advantageous.

4. Instamojo:

- Description: Instamojo (https://www.instamojo.com) is known for its simplicity and ease of use, particularly for small businesses and startups. It offers various payment links and online store solutions alongside its payment gateway.

- Key Features:

- Easy setup and integration.

- Supports UPI, net banking, credit/debit cards, and wallets.

- Offers features like payment links for easy sharing.

- Provides tools for collecting payments via social media.

- Suitable for businesses without a full-fledged website initially.

- Why it’s great for Raipur businesses: For new or smaller businesses in Raipur looking for a quick and straightforward way to accept online payments, Instamojo’s simplicity is a major plus.

5. BillDesk:

- Description: BillDesk (https://www.billdesk.com) is another established player in the Indian payment gateway market, particularly known for its strong presence in bill payments and its reliability.

- Key Features:

- Supports a wide range of payment options.

- Known for its secure and reliable infrastructure.

- Extensive experience in the Indian market.

- Often preferred by larger enterprises.

- Why it’s great for Raipur businesses: For established businesses in Raipur looking for a robust and reliable payment gateway with a proven track record, BillDesk is a solid option.

Factors to Consider When Choosing a Payment Gateway

When selecting a payment gateway for your eCommerce site in Raipur, consider the following factors:

- Transaction Fees: Understand the percentage charged per transaction and any other associated costs.

- Payment Methods Supported: Ensure it supports the payment options preferred by your target audience in Raipur and India.

- Integration Ease: Check how easily it integrates with your eCommerce platform (e.g., WooCommerce, Shopify).

- Security: Look for PCI DSS compliance and robust fraud prevention measures.

- Customer Support: Evaluate the availability and responsiveness of their support team.

- Settlement Time: Understand how long it takes for the funds to be credited to your account.

- User Experience: A smooth and intuitive payment process for your customers.

Integrating a Payment Gateway with Your WordPress (Rank Math) eCommerce Site

If you’re using WordPress with WooCommerce, integrating a payment gateway is usually straightforward. Most popular payment gateways offer plugins that simplify the process. Here’s a general outline:

- Choose your payment gateway: Based on the factors discussed above.

- Sign up for an account: Create an account with your chosen payment gateway provider.

- Install the plugin: Search for the official plugin of your chosen payment gateway in the WordPress plugin repository and install it.

- Configure the plugin: Follow the instructions provided by the plugin to connect it to your payment gateway account using API keys or other credentials.

- Test thoroughly: Conduct test transactions to ensure the integration is working correctly before going live.

FAQs:

Which is the most popular payment gateway in India?

While popularity can fluctuate, Razorpay and Paytm are currently very popular choices due to their wide acceptance of payment methods, including UPI, and their user-friendly interfaces.

How do I integrate a payment gateway with my WordPress WooCommerce store?

Most payment gateways offer official plugins for WooCommerce. You’ll need to install the plugin and configure it with the API keys or credentials provided by your payment gateway account.

What are the common transaction fees for payment gateways in India?

Transaction fees vary depending on the payment gateway and the payment method. They typically range from 1% to 3% per transaction. It’s essential to compare the fee structures of different providers.

Is UPI a must-have payment option for Indian eCommerce?

Yes, UPI (Unified Payments Interface) has become a dominant payment method in India. Offering UPI is crucial for catering to a large segment of Indian online shoppers.

Which payment gateway is best for small businesses in Raipur?

Instamojo is often a good choice for small businesses due to its easy setup and features like payment links. Razorpay also offers competitive pricing and a wide range of features suitable for growing businesses.

CTA :

Ready to power up your Raipur (https://webitof.com/)-based eCommerce business with seamless payments? Explore the payment gateways mentioned above and choose the one that best fits your needs and helps you connect with more customers right here in Chhattisgarh and across India!